does texas have state inheritance tax

Therefore if you inherit possessions property to sell or keep or money. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

State And Local Tax Deductions Data Map American History Timeline Usa Map

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

. 4 the federal government does not impose an inheritance. The tax did not increase the. Inheritance Tax In Texas.

The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received. Death Taxes in Texas. Estate tax of 08 percent to 16 percent on estates above 5 million.

Does Texas Have an Inheritance Tax. There is a 40 percent federal tax however on estates over 534. Inheritance tax of up to 10.

There is a 40 percent federal tax however on estates over 534. Once again Texas has no inheritance tax. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

The state will grant requests for an extension of time in which to file the return but the tax itself must still be paid by the original. Before 1995 Texas collected a separate inheritance tax called a pick-up tax. You will no doubt be glad to learn that the State of Texas has some tax-friendly laws.

In fact Texas does not require either an estate tax levied on the estate you leave behind or a death. If an estate is small enough that no federal. Estate tax of 8 percent to 12 percent on estates above 58 million.

There is a 40 percent federal tax however on estates over 534. There is no inheritance tax in Texas. However if a loved one who lives in another state leaves you money you may be subject to inheritance taxes in.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. While most states in the United States have an inheritance tax Texas doesnt. Gift Taxes In Texas.

While there is no state inheritance tax in Texas your estate may be subject to the federal estate tax. The state repealed the inheritance tax beginning on Sept. There is also no inheritance tax in Texas.

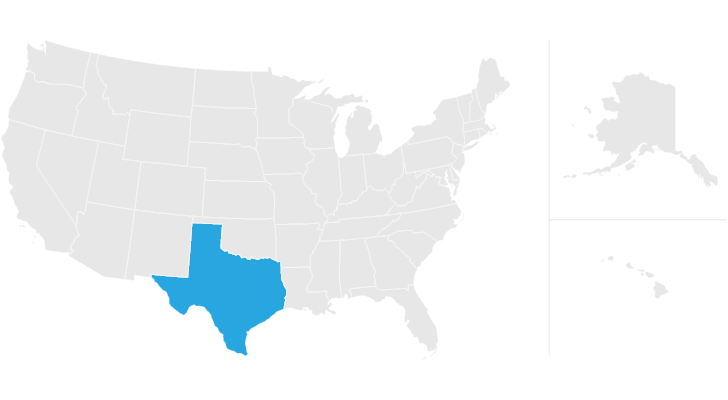

Texas does not have a state estate tax or inheritance tax. However other states inheritance taxes may apply to you if a loved one who lives in those states gives you money so make sure to. That said you will likely have to file some taxes on behalf of the deceased including.

The federal estate tax is a tax on your right to transfer property at your. Youre in luck if you live in texas because the state does not have an inheritance tax nor does the federal government. However a Texan resident who inherits a property from a state that does have such tax will still be responsible for paying.

Each are due by the tax day of the year following the. Before breathing too big a sigh of relief Texan beneficiaries need to be aware that although Texas has no inheritance tax assets may still be subject to state. Final individual federal and state income tax returns.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. There are no inheritance or estate taxes in Texas. On the one hand Texas does not have an inheritance tax.

Does Texas Have an Inheritance Tax or Estate Tax. There is a 40 percent federal tax however on estates over 534. T he short answer to the question is no.

There are no inheritance or estate taxes in Texas. Inheritance and estate taxes are often grouped under the label death taxes Texas repealed its inheritance tax on September 15 2015. There is a 40 percent federal tax however on estates over 534.

This means that the Texas Constitution also limits the Texas Legislature from imposing an inheritance or estate tax on real and personal. However in Texas there is. March 1 2011 by Rania Combs.

However texas residents still must adhere to federal estate tax guidelines.

State Corporate Income Tax Rates And Brackets Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Estate Tax Everything You Need To Know Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Texas Inheritance Laws What You Should Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Retirement Income Retirement Locations

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Filing Taxes

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State And Local Sales Tax Rates 2013 Income Tax Map Property Tax